LANGUAGE↓

News & Policies

Stamp duty has new rules! 7 situations where you don’t need to pay stamp duty!

The "Stamp Tax Law of the People’s Republic of China" passed! It will be officially implemented on July 1, 2022!

The main contents are summarized as follows:

1. Reduce the scope of taxation

Abolish the stamp duty of 5 yuan on each piece of rights and licenses

2. Reduced tax rates

1). The tax rate of stamp duty on contract, construction project and transportation contract has been reduced from 5/10,000 to 3/10,000;

2). Tax rate reduction for some property rights transfer contracts: The stamp duty rate for the transfer of trademark rights, copyrights, patents, and know-how is reduced from 5/10,000 to 3/10,000.

3). The tax rate of stamp duty on business account books has been reduced from 5/10,000 of the "total paid-in capital and capital reserve" to 2.5/10,000, and the regulations of Caishui [2018] No. 50 are directly incorporated into the legislation.

3. Clarifying that value-added tax is not the basis for calculating and paying stamp duty

Note: If the contract signed by the taxpayer is tax-inclusive and the value-added tax is not listed separately, the stamp duty shall be calculated and paid in full.

4. The mantissa requirement is abolished, and the tax is paid directly according to the actual tax amount.

That is to say, starting from July 1, 2022, taxpayers will no longer need to round up when calculating stamp duty. In the future, you will calculate as much as you want, and you will no longer have to worry about the difference between payable and actual payment.

5. New provisions on stamp duty withholding agents

The original "Interim Regulations on Stamp Duty" did not stipulate how foreign individuals should pay stamp duty and whether or not to implement at-source withholding. This legislation adds provisions in this regard: if the taxpayer is an overseas entity or individual and has an agent in China, the agent shall be the withholding agent; otherwise, the taxpayer shall pay by itself. The specific measures shall be prescribed by the competent taxation department of the State Council.

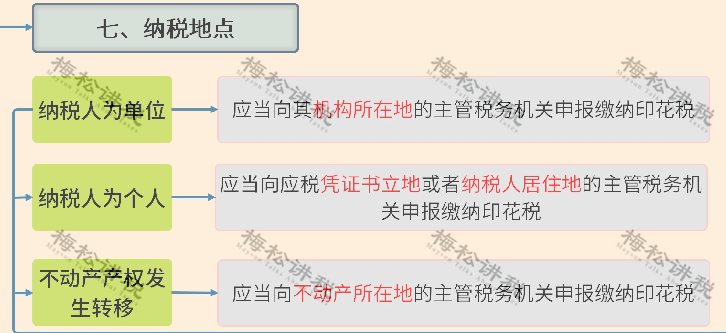

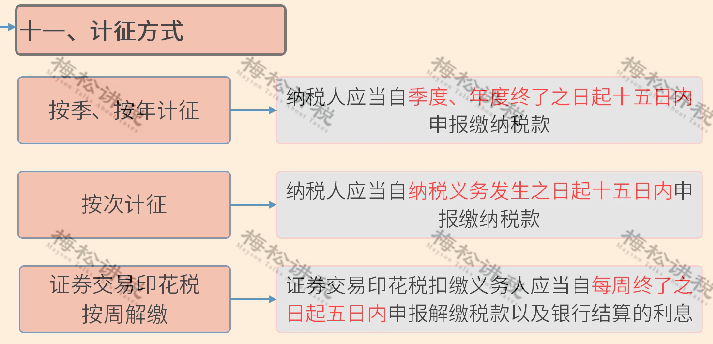

6. Clarify the tax period and tax location

The original "Interim Regulations on Stamp Tax" did not clearly define the tax payment period and place.